Introduction

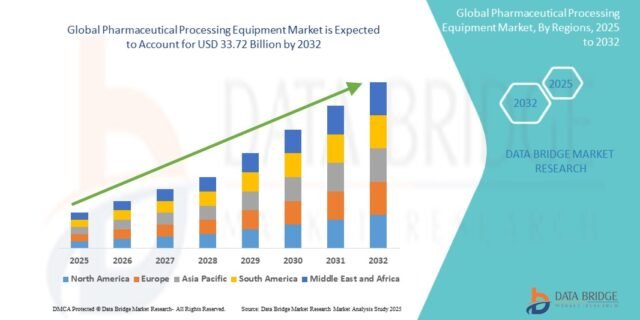

The global pharmaceutical processing equipment market, valued at $21.4 billion in 2024, is projected to reach $38.6 billion by 2030, growing at a 8.7% CAGR. This critical sector forms the backbone of drug manufacturing, ensuring precision, efficiency, and compliance across production processes. As pharmaceutical companies face increasing pressure to accelerate production while maintaining stringent quality standards, advanced processing equipment has become indispensable for modern drug manufacturing.

Source: https://www.databridgemarketresearch.com/reports/global-pharmaceutical-processing-equipment-market

The Evolution of Pharmaceutical Processing Equipment

Initially, pharmaceutical manufacturing relied on basic manual equipment. However, the post-war period brought mechanization to drug production. Subsequently, the 1980s saw the introduction of computerized systems, marking a significant leap forward. Meanwhile, regulatory requirements became increasingly stringent worldwide.

Later, the 2000s introduced single-use technologies that revolutionized biopharmaceutical production. For instance, disposable bioreactors reduced contamination risks substantially. Furthermore, automation began transforming entire production lines. Today, the industry is witnessing the fourth industrial revolution with smart, connected equipment powered by AI and IoT technologies.

Current Market Trends

Presently, five transformative trends are reshaping the landscape:

1. Industry 4.0 Integration

Specifically, 42% of new equipment now incorporates:

- Real-time monitoring sensors

- Predictive maintenance capabilities

- Automated quality control systems

2. Single-Use Technology Expansion

Consequently, disposable systems now account for 38% of bioprocessing equipment.

3. Continuous Manufacturing Adoption

Particularly, FDA-endorsed continuous processing shows 30% efficiency gains.

4. Modular Facility Designs

Moreover, prefabricated cleanroom modules reduce deployment time by 45%.

5. Sustainability Focus

Accordingly, energy-efficient designs now dominate 65% of new purchases.

Key Market Challenges

Despite rapid growth, the industry faces significant hurdles:

1. High Capital Costs

Specifically, advanced equipment requires $2-5 million investments per line.

2. Skilled Labor Shortages

Alarmingly, 32% of manufacturers report difficulties finding qualified technicians.

3. Regulatory Complexity

Particularly, varying international standards complicate global operations.

4. Technology Integration

Unfortunately, legacy systems often resist modernization efforts.

5. Supply Chain Vulnerabilities

Notably, semiconductor shortages delay automation component deliveries.

Market Scope and Segmentation

By Equipment Type:

- Mixing Equipment (22%)

- Milling Equipment (18%)

- Coating Equipment (15%)

- Filling & Packaging (25%)

- Others (20%)

By Mode of Operation:

- Automatic (58%)

- Semi-automatic (32%)

- Manual (10%)

By End-User:

- Big Pharma (45%)

- Generic Manufacturers (30%)

- CMOs (25%)

By Region:

- North America (38%)

- Europe (29%)

- Asia-Pacific (27%)

- ROW (6%)

Market Size and Growth Drivers

Projected expansion to $38.6 billion by 2030 stems from:

1. Biologics Boom

Specifically, the $526 billion biologics market demands specialized equipment.

2. Generic Drug Expansion

Consequently, 78% of prescriptions now use generics.

3. Regulatory Push

Particularly, FDA’s PAT initiative encourages advanced monitoring.

4. Emerging Markets

Moreover, Asia’s pharmaceutical output grows 12% annually.

5. Pandemic Preparedness

Accordingly, governments are stockpiling manufacturing capacity.

Conclusion

Ultimately, pharmaceutical processing equipment stands at a technological crossroads. Going forward, three developments will prove decisive:

1. AI-Optimized Manufacturing will become standard

2. Flexible Modular Systems will dominate new facilities

3. Green Technologies will gain regulatory preference

Thus, equipment manufacturers embracing these shifts will lead the next era of drug production.