The digital age has brought with it a revolution in the world of finance, and at the heart of this change lies crypto trading. From the first Bitcoin transaction in 2009 to today’s expansive marketplace of thousands of digital currencies, crypto trading has evolved from an obscure interest to a global financial movement. But what exactly is crypto trading, and why is it attracting millions of investors around the world?

In this blog, we’ll break down what crypto trading is, how it works, its risks and rewards, and tips for beginners who want to enter this high-potential digital frontier.

What is Crypto Trading?

Crypto trading is the act of buying and selling cryptocurrencies with the aim of making a profit. Unlike traditional stock markets, which have fixed trading hours, the crypto market operates 24/7. This allows traders the flexibility to trade at any time, day or night.

At its core, crypto trading involves speculating on the price movements of cryptocurrencies. Just like forex or stock trading, traders buy when they believe prices will rise and sell when they expect prices to fall. However, due to the volatile nature of the crypto market, price movements can be significantly more extreme than in traditional markets.

How Does Crypto Trading Work?

Crypto trading can take several forms, the most common being:

1. Spot Trading

This is the direct purchase or sale of cryptocurrencies like Bitcoin, Ethereum, or Ripple. When you buy a coin through a platform like Binance, Coinbase, or Kraken, you own that digital asset outright.

2. Margin Trading

Margin trading involves borrowing funds to trade larger positions than your initial investment. While this can increase potential profits, it also magnifies losses.

3. Futures and Derivatives Trading

This allows traders to speculate on the future price of cryptocurrencies without actually owning them. Futures trading can be lucrative but comes with higher risks.

4. Automated or Bot Trading

Some traders use algorithms or bots to make trades based on predefined strategies. This can remove emotional decision-making and allow 24/7 trading.

Why is Crypto Trading So Popular?

Several factors contribute to the popularity of crypto trading:

- High Volatility: The crypto market’s constant fluctuations provide ample opportunities for profit.

- Low Entry Barrier: With as little as a few dollars, anyone can start trading.

- Global Accessibility: All you need is an internet connection and a digital wallet.

- Decentralization: Unlike traditional markets controlled by banks or governments, crypto trading operates on decentralized platforms.

Risks of Crypto Trading

While crypto trading can be highly rewarding, it’s important to understand the risks involved:

1. Volatility

Crypto prices can swing wildly within minutes. While this creates profit opportunities, it also leads to significant losses for the unprepared.

2. Security Risks

Despite blockchain technology being secure, crypto exchanges and wallets can be hacked. In 2014, Mt. Gox, once the world’s largest Bitcoin exchange, lost 850,000 BTC to hackers.

3. Regulatory Uncertainty

Crypto trading is still under legal scrutiny in many countries. Regulations vary widely, and sudden changes can impact the market drastically.

4. Lack of Knowledge

Many beginners enter the crypto world expecting quick riches. Without proper education and strategy, they can quickly lose their investments.

Getting Started with Crypto Trading

If you’re new to crypto trading, here are some basic steps crypto trading platforms to help you begin:

1. Choose a Reliable Exchange

Start by choosing a secure and user-friendly crypto exchange. Popular choices include Binance, Coinbase, Kraken, and KuCoin. Look for platforms with good liquidity, security, and support.

2. Create a Wallet

A crypto wallet stores your digital assets. Hot wallets are online and convenient but less secure, while cold wallets (offline devices) are more secure but less accessible.

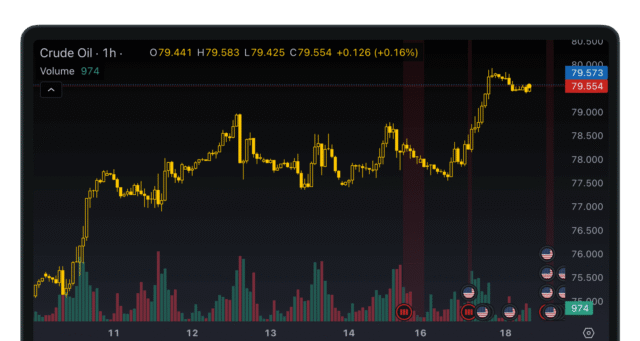

3. Learn Technical and Fundamental Analysis

Technical analysis involves studying price charts and trends, while fundamental analysis looks at the technology, team, and use case behind a coin. Combining both can give you a better trading edge.

4. Start Small

Don’t invest more than you can afford to lose. It’s wise to begin with small trades while learning the ropes.

5. Diversify Your Portfolio

Don’t put all your funds into one cryptocurrency. Spread your investments to reduce risk.

Tips for Successful Crypto Trading

To thrive in the fast-paced world of crypto trading, consider these tips:

- Stay Updated: Follow crypto news sites like CoinDesk or CoinTelegraph to stay informed on market trends.

- Set Stop-Loss and Take-Profit Levels: This protects your capital and locks in profits.

- Avoid FOMO: Fear of missing out often leads to impulsive decisions. Stick to your strategy.

- Practice Patience: Crypto trading isn’t a get-rich-quick scheme. Focus on long-term learning and growth.

- Use Demo Accounts: Many platforms offer demo accounts to practice trading without risking real money.

The Future of Crypto Trading

The future of crypto trading looks promising. As blockchain technology continues to advance, we can expect faster transactions, more regulatory clarity, and greater mainstream adoption. With institutional investors entering the space, the market is maturing, bringing with it more stability and new trading opportunities.

Moreover, innovations like decentralized finance (DeFi) and NFTs are opening new trading avenues. While challenges remain, crypto trading is no longer a fringe activity — it’s becoming a vital part of the global financial ecosystem.

Final Thoughts

Crypto trading is both exciting and complex. It offers incredible opportunities, but only to those who are willing to learn, strategize, and take calculated risks. As with any investment, due diligence and continuous learning are your best allies.

Whether you’re a curious beginner or a seasoned trader, the world of crypto trading has something for everyone. Dive in with caution, stay informed, and embrace the evolution of finance in the digital age.

See more our website : trading