Introduction

Asia-Pacific premium chocolate market in the Asia-Pacific region is experiencing strong momentum, reflecting a broader shift in consumer behavior towards indulgence, quality, and healthier eating habits. As the middle-class population grows and urbanization accelerates, consumers are displaying a heightened willingness to spend on high-quality, artisanal, and ethically produced chocolates. This evolution is not merely about taste — it is about lifestyle, status, and personal wellness.

From metropolitan centers in Japan and China to emerging economies like India and Vietnam, premium chocolate is being recognized not just as a confectionery product but as an experience. Influenced by Western trends and a rising focus on self-care and premium gifting, the region’s chocolate industry is undergoing a transformation that places craftsmanship, ingredients, and storytelling at the forefront.

Source – https://www.databridgemarketresearch.com/reports/asia-pacific-premium-chocolate-market

Market Overview

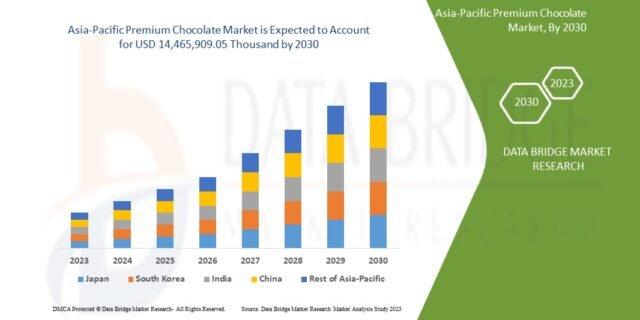

The Asia-Pacific premium chocolate market has grown significantly over the past decade and is expected to continue on a robust trajectory. This growth is attributed to increasing disposable incomes, changing dietary preferences, and a rising demand for luxury food items. As consumers become more health-conscious, they are gravitating toward products with higher cocoa content, reduced sugar, and clean labels — all hallmarks of premium chocolate.

Key Market Drivers

1. Rising Disposable Income

As economies across Asia-Pacific continue to expand, more consumers are able to afford premium and imported products. This purchasing power has led to a noticeable rise in the consumption of gourmet and high-end chocolate varieties.

2. Health and Wellness Trends

Dark chocolate, especially with high cocoa content, is seen as a healthier alternative to traditional sweets. Premium chocolate often contains fewer additives and artificial ingredients, aligning with the wellness-driven preferences of urban consumers.

3. Growth of Gifting Culture

Cultural and corporate gifting has always been significant in countries like Japan, China, and South Korea. Premium chocolates, with their elegant packaging and luxurious appeal, are increasingly chosen as ideal gifts for holidays, festivals, and professional occasions.

4. Western Influence and Globalization

International travel, digital exposure, and foreign brand entry have introduced consumers to new flavors, formats, and product standards. This has elevated expectations and increased the demand for premium chocolate experiences.

5. Expansion of E-Commerce and Specialty Retail

Digital platforms and boutique chocolate stores have made premium chocolates more accessible across urban and even semi-urban areas. Customization, online gifting options, and direct-to-consumer models are boosting sales.

Market Segmentation

By Product Type

- Dark Chocolate: The preferred choice for health-conscious and premium consumers.

- Milk Chocolate: Still holds a strong market share, particularly among younger demographics.

- White and Specialty Chocolates: Including flavored, infused, or functional varieties.

By Distribution Channel

- Offline: Gourmet stores, supermarkets, and duty-free retail.

- Online: Brand-owned websites and third-party marketplaces offering subscription boxes and seasonal packages.

By Country

- Japan and China: Mature premium chocolate markets with strong brand loyalty.

- India: Fastest-growing market, driven by urban youth and rising income levels.

- Southeast Asia: Increasing chocolate penetration, particularly in Malaysia, Thailand, and Indonesia.

- Australia and New Zealand: Established markets with a strong preference for organic and ethically sourced chocolate.

Industry Challenges

1. High Price Point

Premium chocolate remains inaccessible to lower-income groups, limiting its reach in rural and semi-urban markets.

2. Supply Chain Disruptions

Cocoa sourcing challenges, coupled with fluctuating raw material prices, impact product consistency and profit margins.

3. Cultural Preferences

In some parts of Asia, chocolate is not traditionally part of the daily diet, requiring significant marketing efforts to change consumption habits.

4. Brand Competition

The market includes a mix of global giants and local artisans, all vying for a share of the premium segment. Standing out requires strong branding, innovation, and marketing.

Emerging Trends

- Sustainable and Ethical Sourcing: Consumers increasingly favor brands that are transparent about their supply chains and fair trade practices.

- Functional Ingredients: Chocolates infused with ingredients like matcha, turmeric, collagen, or probiotics are gaining attention.

- Customization and Personalization: Made-to-order chocolate boxes, monogrammed wrappers, and gift-ready packaging are helping brands build loyalty.

- Experiential Retailing: Tasting sessions, workshops, and brand storytelling enhance consumer engagement and justify premium pricing.

Market Outlook

The Asia-Pacific premium chocolate market is poised for sustained growth in the coming years. Continued urbanization, digital transformation, and rising wellness consciousness will drive further innovation and market penetration. Brands that focus on authenticity, premium sourcing, personalization, and direct consumer relationships are expected to thrive.

The competitive landscape will likely evolve with increased collaboration between global players and local artisans, bringing together heritage, innovation, and localized flavor profiles. With increasing cultural acceptance of chocolate as a sophisticated, everyday luxury, the future of premium chocolate in Asia-Pacific looks both promising and delicious.